|

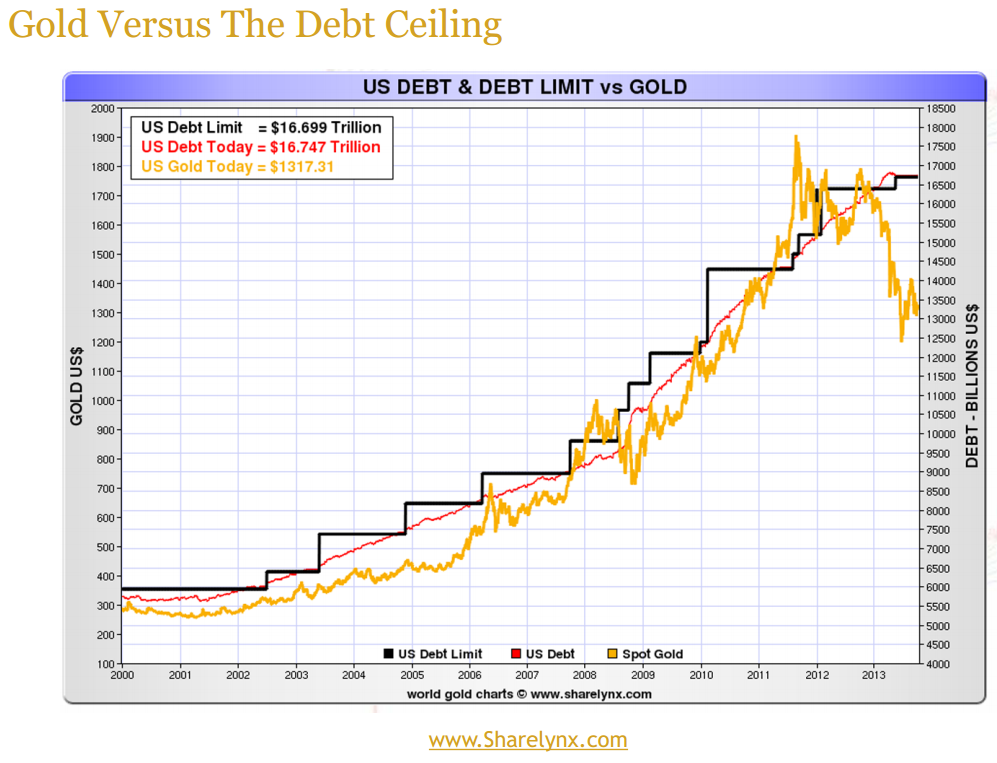

While it looks distinctly like the relationship of Gold with QE and with America’s National Debt has finally broken big-time after 13 correlated years, there’s a bit of a caveat and explanation. That’s beside the fact that one break down does not prevent another break up. The fundamental econometrics of too much money chasing too few real goods will eventually result in higher asset values. True, gold is good for nothing and earns no interest, but it is still the one commodity that has truly been held “dear” throughout all of known history.

The caveat is rank manipulation.

Can that really be? Why and who could do it?

Who but governments can sell enough gold to counteract market demand and intimidate investors from optimistically betting against the continued decline in dollar purchasing power?

It benefits government and politics to show weakness in gold. It hurts to admit currency weakness, so governments sell or threaten to sell gold until buyers stay out of the way. Threatening tapering has caused gold to lose luster, even though not a shred of tapering has ever yet occurred.

In addition, American oil self-sufficiency and periodical flight capital from the rest of the world have strengthened the dollar from time to time, but when the massive pools of liquidity that are still locked up in the bank balance sheets ever come out, inflation will start. Yet interest rates will not be allowed to rise as much to compensate for inflation: it would be too costly to government deficits. Thus gold will not be hurt as much as analysts may think.

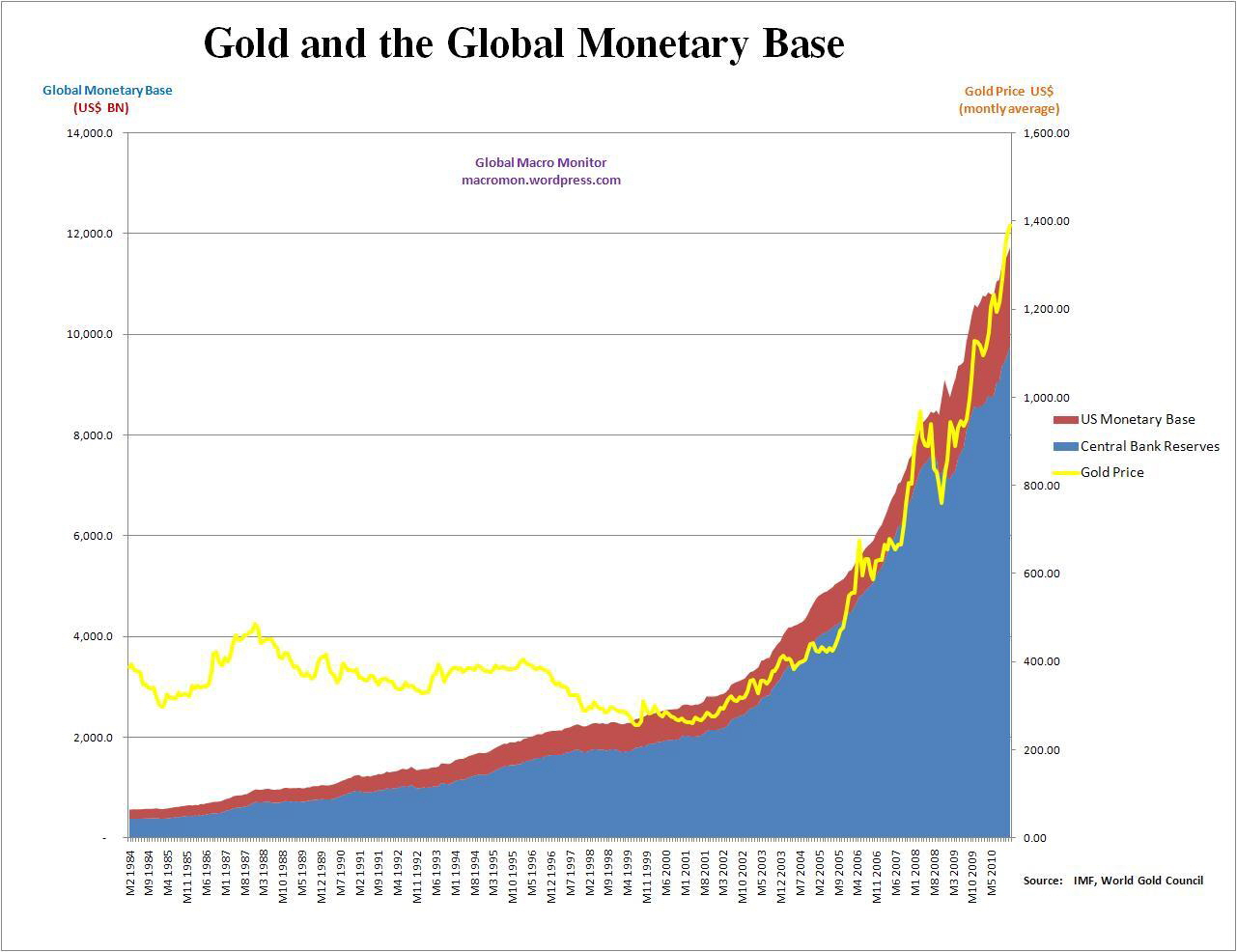

That doesn’t make the life of investors any easier. But it does mean to us that the trend to follow increases in debt levels will resume eventually. The chart below relates gold to the monetary base, which despite being locked up and relatively inactive, is still growing.

|